2022 Triangle Tweener List (old version, see below)

Note this document is now replaced 7th edition, published in 2022 to cover 2021, the 2023 8th edition of the Tweener List is now living over at www.tweenerlist.com. Also, we have launched a sister investment vehicle that is always accepting new accredited investors (LPs), at www.tweenerfund.com.

We keep these old versions alive for historical links and usage, but be sure to visit the site above.

-Scot

Welcome to the seventh annual Triangle Tweeners List! This list features details on over 250 curated startups in the Triangle (the North Carolina high-tech Research Triangle Park corridor that includes Raleigh, Durham and Chapel Hill) that I call Tweeners. What’s a Tweener? Read on…

In the last year I’ve upgraded the Tweener list with two new offerings:

- Triangle Tweener List newsletter — If you like this content, sign up for our newsletter for updates on not only the annual list, but a variety of interesting updates on the Triangle startup scene. Sign up for our Triangle Tweener Newsletter here: tweener.substack.com

- Triangle Tweener Fund — In January of 2022, I launched an Angel List rolling fund that invests with a focus in Triangle Tweeners. It’s creatively called the Triangle Tweener Fund and is only available to accredited investors.

We have over 100 of the top entrepreneurs and ecosystem providers in the Triangle as investors (LPs).

If you are a startup in the Triangle, we’d love to talk to you about an investment, reach out here.

If you are an accredited investor and interested in investing in a basket of the Triangle’s top startups, you can learn more here: www.tweenerfund.com.

The minimum investment to join is $20k compared to $300k+ for traditional venture fund investments.

Note that each Tweener fund investment will be marked with “***Tweener Fund Portfolio Company. “

Thanks to our Sponsors!

We are proud to be sponsored by three awesome companies in the Triangle startup ecosystem:

HPG is a full-service accounting firm focused on startups from start to Tweener Graduate. HPG can help you with a variety of startup-needs: augmenting your team, audits, tax help, international expansion, and even personal wealth planning (pro tip: don’t wait until you have an exit/liquidity event to do this ’cause that’s too late). Full disclosure: HPG is our accounting firm at Spiffy and I have utilized them in many other companies and for some personal tax needs.

http://www.RobinsonBradshaw.com

Robinson Bradshaw is a Carolinas-based boutique business law firm with a Silicon Valley-level of startup knowledge. Need help on VC financings, M&A, IP, litigation, people issues, option plans, company formation or any of the other issues we deal with daily in startup-land? Give Robinson Bradshaw a call. Full disclosure: RB is our legal counsel at Spiffy and I have worked with them in many other companies.

Headquartered in North Carolina, Bank of America can grow with you through all stages so you can focus on scaling your business. BofA delivers both local coverage and industry expertise to provide a wide range of financial services, integrated working capital management and treasury solutions, and underwriting and advisory services. BofA is committed to delivering world-class digital capabilities that empower our clients to do business anywhere, anytime and make doing business for our clients faster, smarter, and more secure. To find out more, please visit: business.bofa.com.

Thanks for checking out our sponsors and be sure to let them know you learned about them from the Triangle Tweener list!

In addition to the sponsors, I’d also like to thank the great folks in our Triangle startup community at CED, BCVP, IFP (soon to be Janus Venture Partners), Cofounders Capital, American Underground, Raleigh Founded (previously HQ Raleigh), Square1, Bridge Bank, Live Oak, WIN, CAN, TAP, DAN and more that have been instrumental in helping keep me updated on all the companies in the Triangle that should be considered for the Triangle Tweener List. This list is definitely a big team effort and wouldn’t be possible without the behind-the-scenes help I get from everyone in the community. Finally, I want to thank Triangle startup enthusiast Derek Pando. Derek contributed a ton of time helping me sort through the myriad new companies in the Triangle springing up everywhere. Thanks Derek! (Note Derek’s Tweener volunteer time is done, if you have questions/concerns about the Tweener list, route them to me).

What is a Triangle Tweener?

Triangle Tweeners have the following criteria:

- They must be headquartered in the Triangle. Note — due to COVID, I’ve gotten a bit more flexible here — there are 5–10 companies that are semi-HQ’d in the Triangle this year.

- They need to be a technology company — software, hardware, tech-enabled services, digitally native brands, e-commerce, etc. No agencies, or consultancies. No life science companies (drugs, CRO, medical devices, compounds)

- Have a minimum of $1,000,000/yr ($80k/m) in sales OR 10 people. Or as we say in startup-land, $1m ARR or $80k MRR.

- Once a company is over $80m/yr in revenue or 500 employees they ‘graduate’ off the list.

Think of Triangle Tweeners as the ‘Goldilocks’ companies in the Triangle — not too small and not too large. These are our future breakouts, big fund-raisers, acquisition targets and (fingers crossed) IPOs. Tweeners are also great for folks moving to the area to target for their first Triangle gig, or if you are at a big company locally and want to try something more entrepreneurial — check out a Tweener today!

About the Author

I’m Scot Wingo, Triangle-area serial entrepreneur (Stingray Software, AuctionRover, ChannelAdvisor and Spiffy).

You can find me on Twitter (here) or LinkedIn (here). Full disclosure — I am still a Director at ChannelAdvisor and Co-founder and CEO of Spiffy (A Triangle Tweener). I also am a LP (Limited Partner or investor) in Bull City Partners, IFP, Co-founders Capital and the Wolfpack Investment Network (aka WIN). Finally, I’m a GP at Triangle Tweener Fund which is obviously completely intertwined/inspired by this list.

FAQ: Why do you do this? (What’s the catch?!?)

Good question and we live in skeptical times, so I get this question a lot. The short story is when I started my first company, I was 27 with an engineering degree and was so green that I would have completely failed if not for the generous mentorship of folks like Dr. Tom Miller, Walter Daniels, Richard Holcomb and Chris Evans. It got to the point that I was chewing up a LOT of their time and I finally asked how I could compensate them. They said — “in the Triangle we pay it forward, someday you will be able to repay the favor to a 2X yr old first-time founder”. And here we are. BTW, to save room at the top of the article here, I’ve put a section at the very bottom of the page that is links to the archives of the Triangle Tweener List if you want to do a little time traveling and fact check me on all this.

2022 Update: The Big Picture

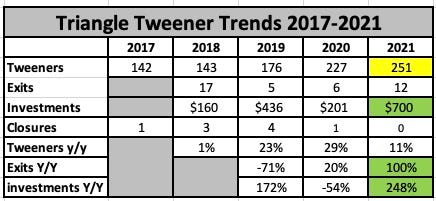

The 2022 Tweener list reflects the activity of 2022. I’ve been doing the list in a more data rich format for 4 years so we have some interesting trends we can look at summarized in this table:

A couple of highlights:

- Exits are up 100% y/y — After a bit of a slow-down in exits in 2019/2020, things really heated up in 2021. One trend that benefited the Triangle Tweeners was a surge in private equity (PE). PE firms look for companies that exhibit the ‘Rule of 40’ (IMHO you should learn about this if you are in startup-land) and because of our tighter capital markets, many of our companies fit their profile — growing > 40% y/y and profitable, so the number of PE firms hunting in the Triangle has exploded, and the deals have followed. The ‘2022 Update: Acquisitions’ section below has all the deals from 2021. It’s hard to get the values of the deals, but for the 3 that disclosed, the value was over $300m!

- Investments are up 248% — Bazinga!!, this was an incredible year for fundraising. I even didn’t include the Pendo $150m+110m raises (one of those is tagged as secondary so may not ‘count’ as fresh capital). I won’t list all the fundings here (they are detailed in 2 sections), but when you add those up you get over $700m in investments. Remember, that’s just the investments in Tweeners. For a long time, I’ve argued that, yes we need more VCs in the area, but if we build great companies, investors will come. That was really proven out in 2021. Our local VCs are $150m funds and we had 4–5x that amount flood into the area. One caveat here. Sometimes when PE firms buy a controlling (>50%) interest in a firm, it’s not clear if that is an M+A or a funding. My default position here is to go with the language of the press release, but override that if I have some information on behind the scenes.

- Tweeners (count) up 11% — This one is a bit tricky because we graduated some and the M+A number was high we lost a lot of Tweeners for all the best reasons. Specifically the math is: Started with 227 tweeners (from 2020), we lost 13 from M+A and graduation (down to 214) and then we added 37 for a total of 251. Another way to do this math would be to look at the ‘organic’ growth of tweeners, taking out the impact from exits and grads and that would be ~20%. Another insight — for every Tweener I meet, there are 10 ‘soon-to-be’ Tweeners, so I believe the pipeline is quite robust. More on that in next section.

- Bottom line — The Triangle startup ecosystem is a flywheel and what makes the flywheel go faster are entrepreneurs, investment capital, revenues, M+A and graduations — all in an interconnected circle. For example, this year’s 12 acquisitions and Pendo’s graduation, those events will hopefully create a new crop of entrepreneurs that start new co’s, get funding, become Tweeners, and round and round it goes. This year the flywheel accelerated nicely with all that capital coming in, a robust growth of Tweeners and the exits all tee us up for continued accelerating momentum and a healthy ecosystem.

2022 Update: Acquisitions

In 2021 we saw a whopping 12 Tweener Exits, the second highest on record only topped by 2018’s 17 exits. Sadly these Tweeners are off the list because while many of them will maintain a presence in the Triangle, their HQs are no longer here. While most M+A does not disclose a price, three of these did and the cumulative amount was $336m — that was for 3!

- Pro-ficiency was acquired by NovaQuest on 2/23/21

- Pureport was acquired by Digital Realty 3/3/21

- Republic Wireless (Bandwidth — a Tweener Graduate — spin-out) was acquired by Dish Network on 3/8/21

- d-Wise was acquired by Instem on 3/22/21 (for a reported $31m)

- Joulebug was acquired by Carimus on 4/5/21

- Core Compete was acquired by Accenture on 4/7/21

- Vanguard Software was acquired by Wolters Kluwer for $100m on 5/14/21 (Congrats Neal!)

- Fantasy Life was acquired by Betsperts on 5/26/21

- Spoonflower was acquired by Shutterfly for $225m on 6/14/21

- EmployUS was acquired by Hireology on 7/13/21

- SignalPath was acquired by Verily on 8/17/21

- Brightdoor was acquired by Cecillian Partners on 10/6/21

- Boostopia was acquired by SupporTrends on 10/11/21

- ReverbNation was acquired by BandLab on 11/5/21

Congrats everyone! As I write this in May of 22, we’re already off to a really robust M+A year, so we could beat 12 in 2022 if the pace continues.

2022 Update: Graduates and Closures

Aside from acquisition, there are three ways for companies to leave the Tweener list:

- Graduates — The ceiling of the Tweener list is $80m/yr in revenue and by all public accounts, Pendo has passed this level in 2021, so they are now officially a graduate! Congrats Pendozers, excited to see what happens from here and I’m personally hoping for an IPO of epic proportions.

- Closures — Startups are a risky business and over 50% of startups end up failing — this is healthy. If you aren’t pushing hard and failing, you aren’t innovating. Fortunately, once companies get to the Tweener level, the failure rate falls way off. In fact this year we didn’t detect any failures of Tweeners — yeah!

- Shrinkage — Sometimes companies hit a rough spot and dip below our 10 people/$1m ARR criteria — that’s shrinkage. None were detected this year.

2022 Update: Tweener Financings of Note

In 2018 there was ~$150m in investments in Triangle Tweeners then in 2019 it was around $300m and in 2020 we had a decent showing of ~$200m. In 2021 we had a banner fundraising year of $700m not including Pendo’s $140m which would have put it at $850m. Here are the 2022 Triangle Tweener investments from highest to lowest where the amount was given along with the date and lead investor. These come from sources that use the SEC form D’s as their information (e.g. Pitchbook, CrunchBase, etc).

- CData raised $140m 12/16/21 from Updata Partners

- Pairwise Plants raised $90m Pontifax AgTech on 2/3/21

- ServiceTrade raised $85m from JMI Equity on 12/6/21

- Well raised $70m from Valeas Capital Partners on 12/17/21

- Phononic raised $50m from Goldman Sachs on 7/21/21

- ProcessMaker raised $45m from Aldrich Capital Partners on 2/12/21

- JupiterOne raised $30m from Sapphire Ventures on 5/4/21

- Spiffy raised $22m from Tribeca Venture Partners on 10/26/21

- Medicom Technologies raised $21.8m from Oval Park Capital on 11/18/21

- Higharc raised $21m from Spark Capital on 4/21/21

- Adwerx raised $12.5m from Texas Capital Bank on 11/23/21

- PatientPay raised $12m from unknown on 10/12/21

- Pryon raised $12m from Good Growth Capital on 11/24/21

- Kevel (The Tweener Previously known as AdZerk) raised $10m from Fulcrum Equity Partners on 12/9/21

- Lolli raised $15m in two rounds, one on 3/24/21 and one from Acrew Capital on 7/28/21

- Levitate raised $8m from unknown on 2/25/21

- FinMark raised $6.5m

- ndustrial.io — $6m from Clean Energy Ventures and ENGIE New Ventures on 5/5/21

- Dart Displays raised $5.5m from undisclosed investor on 11/9/21

- SWIR Vision Systems raised $5m on 10/19/21

- Triggermesh raised $5m from Cisco’s venture arm on 7/13/21

- AllStacks raised $4m from TDF Ventures on 7/1/21

- marGo raised $4m from 1/11/21

- PRTI raised $3.7m from undisclosed on 7/26/21

- Stitch Golf raised $3.6m from undisclosed on 1/27/21

- Diveplane raised $3m from undisclosed on 9/22/21

- Element451 raised $3m from Cultivation Capital on 4/22/21

- Revibe Technologies raised $3m from Carolina Angel Network and others on 4/15/21

- LoanWell raised $3m on 12/7/21

- Alcove raised $2.3m from undisclosed on 6/1/21

- CureMint raised $2.2m on 10/20/21

- Klearly raised $1.6m on 4/30/21

- Pattern Health raised $1.5m from Cofounders Capital and Launch Place 2/15/21

- Aries raised $1.1m on 2/16/21

- RepVue raised $1m from Knoll Ventures on 6/29/21

- Convoy raised $1m on 12/31/21

- TRAKID raised $1m on 12/15/21

- Mesur.io, TopCourt, Slingshot Coffee all raised < $1m rounds

2022 Update: New to the Tweener list:

We’ve also discovered 37 new Tweeners that we’re adding to the list this year. Note: you can search for the new additions by searching for “New for 2022”

- Acre

- Arpio

- Atmos

- Bloom AI

- ByteBase

- Cameyo

- Cycle Labs

- Dart Displays

- Dendi Software

- Dental HQ

- Devana Solutions

- E-emphasys Technologies

- EarthOptics

- Enmass Energy

- Flexgen

- Green Places

- GrowPath

- Higgs Boson Health

- LogistiVIEW

- Microgrid Labs

- MuukTest

- Omni Creator Products

- Participate

- Persistence AI

- Playmetrics

- Protochips

- PRTI

- RepVue

- ResultID

- Rownd

- Security Journey

- Serve Finance

- Transmira

- Tribe

- Trulabs

- Tumult Labs

- WorkDove

Finally: The 2022 Triangle Tweener List Database

(Drum roll please!) Now without further ado here is the 2022 Tweener List. The list is in alphabetical order and includes a ‘pitch’ for the company (my take on how I would describe them in 2–4 sentences). The size (data sourced from LinkedIn), the investors (data sourced from Crunchbase, GrepBeat, WRAL, etc.), the CEO’s name and a link to the LinkedIn page for the company if you’d like to learn more.

Note you can search for “Updated for 2022” to see what’s new or simply “2022” to see what’s new AND changed.

3 Birds Marketing

Pitch: What happens when you apply modern SaaS MarTech (Marketing Technology) to the car dealer world? 3 Birds is what happens! A big feather in the 3 Birds cap (see what I did there?) is that they are in the Honda and Acura preferred vendor programs.

Size: 100

Investors: none

CEO: Kristen Judd

LinkedIn

6Fusion

Pitch: 6Fusion of Raleigh is standardizing the economic measurement of IT infrastructure and cloud services. It was founded in 2008.

Size: 10–50

Investors: $26M from two investors, Intersouth Partners and Grotech Ventures

CEO: John Cowan

LinkedIn

Acre **New for 2022

Pitch: Second-time entrepreneurs are the most interesting to watch. Mike Schneider and team started First in 2015 and quickly hit the Tweener List. In 2019 they were acquired by RE/MAX. Mike is back and here’s the pitch. There are some interesting trends in the real-estate world at the intersection of PropTech and FinTech. For example, fractional ownership is opening up as is institutional ownership (e.g. PE/institutional firms buying up and leasing houses). Acre is at the intersection of these trends. What if you wanted to share your mortgage/home with an institution? That’s where Acre comes in. They match you with a financial partner to buy the house, both amplifying your buying power and getting you better economics than a traditional mortgage.

Size: 10–50

Investors: <none disclosed>

CEO: Mike Schneider

LinkedIn

Adwerx **Updated for 2022

Pitch: A local/vertical ad:tech (advertising technology) company that in early 2015 spun out of ReverbNation. This Durham team is making it easier for hyper-local verticals (real estate is the first one) to take advantage of the latest advertising technologies. The company tells me that they work with 25% of the top 1,000 Real Estate companies, and 15% of the top Mortgage Originators in the United States, and serve ads for more than 250,000 individual producers per year!

Size: 100–200

Investors: $5.5m that includes Bull City Venture Partners, Novak Biddle Venture Partners, Grotech, Alerion Capital, SeventySix Capital. Raised $12.5m from Texas Capital Bank on 11/23/21 **Updated for 2022

CEO: Jed Carlson

LinkedIn

AgEye Technologies

Pitch: As we explore new ways to grow food more cheaply (and someday on Mars of course), indoor growing is increasingly important. AgEye has developed an indoor growth platform. What’s that you ask? Well several parts — first is hardware including set of IoT (Internet of Things) sensors that monitors things like soil moisture plus cameras. The second part is software that used advanced ML (Machine Learning). Together they help the indoor farmer optimize their crop. “Hey Larry, that radish over there needs 6oz of water today and 1hr more of light, but first turn the bulk 12 degrees to the right”

Size: 25–30

Investors: none

CEO: <unavailable>

LinkedIn

Alcove **Updated for 2022

Pitch: When you go to college and want a roommate, there are tons of mechanisms to do that. Then you get a job in another city where you know nobody, what can you do? Enter Alcove -Alcove is a two-sided marketplace. On one side you have renters looking for great rooms. On the other side, you have people that have extra rooms either in their house or in an apartment they are renting and they want to rent out that extra room. Alcove was founded to solve this problem. Another PropTech co in the Triangle!

Size: 20–50

Investors: $5m from NextView, Bling, Expa, Brad Horowitz, Quarry and Pear VC

CEO: Colin Tai

LinkedIn

Allbridge (previously Bulk Internet and TV)

Pitch: Have you ever stayed in a hotel and wondered how they have Satellite TV in every room? The answer is Allbridge. They make (sell and install) the technology that pulls the signal down and then pipes it into every room in a hotel, office park, apartment building, dorm, etc. Based in Raleigh, Allbridge has quietly and without funding created a very big recurring revenue business. In 2019, Bulk TV merged with DCI and EthoStream to form the new company Allbridge.

Size: 200–300

Investors: none

CEO: David O’Connell

LinkedIn

AllStacks

Pitch: Today’s engineering teams use a complex set of tools to hit peak performance. The challenge for a manager and other leaders in the business is that they lose visibility into what’s going on with various projects because all of the data is spread around. AllStacks pulls in all of your engineering data into one place and then analyzes the data to detect and avoid any problems.

Size: 40–60***Updated for 2022

Investors: $5m from Hyperplane Venture Capital and others. Raised $4m from TDF Ventures on 7/1/21 **Updated for 2022

CEO: Hersh Tapadia

LinkedIn

Appraisal Nation

Pitch: If you have ever bought a house, you had to have an appraisal done. AppraisalNation is both a marketplace of appraisers nationwide and the software platform they use to create and deliver the appraisals.

Size: 100–200

Investors: none

CEO: Michael Tedesco

LinkedIn

Aqueti

Pitch: Aqueti has invented a 100 megapixel resolution camera called Mantis with a very wide range of view. This type of technology has tons of use cases and Aqueti has started in the security space. For example, you could have one camera in a stadium that could see everything in half the stadium at very high resolution. This would replace a system of tens or hundreds of cameras.

Size: 10–20

Investors: none

CEO: Kenneth Darby * Updated for 2021

LinkedIn

ArchiveSocial **Updated for 2022

Pitch: You have a business that is active on social media (aren’t we all?!), but you are in an industry that has document and record-keeping requirements (like finance, healthcare, government, legal, etc.). ArchiveSocial, a Durham startup founded in 2011, automatically pulls, records and archives all of your social media so you are compliant with all the relevant requirements. Note: I realize that ArchiveSocial has now been acquired in 2022, they will come off the list next time (the 22 list will be published in 23 — I know, it’s confusing)

Size: 50–100

Investors: $53m round in 2019 from Level Equity

CEO: Ray Carey

LinkedIn

ArenaCX ** Tweener Fund Portfolio Company **Updated for 2022

Pitch: If you recall Bandwidth developed a consumer wireless solution called Republic Wireless. Inside of their to provide top-notch customer service at the best prices possible, they developed some amazing customer service marketplace and management technology. It was so popular other wireless carriers and other industries wanted to use it, so they spun it out as ArenaCX.

Size: 10–20

Investors: $2m from Sovereign’s Capital and Tweener Fund

CEO: Alan Pendleton

LinkedIn

Aries

Pitch: Chris Evans put the serial in serial entrepreneur. He started with one of the first email systems called DaVinci. Then he followed up with an online ad startup called Accipiter. Then he pivoted from software to material science and started Tethis/New Century Spirits. Never one to take a break, he’s back with another startup. This one is in the PPE space. Chris has taken a space-age fabric out of NCSU that has filtration attributes as good or better than N95, but is much more breathable. The result is the Workweek mask by Aries. At the time of this writing, the Aries mask has become my go-to mask. As a glasses wearer, I haven’t found a mask that is nearly as comfortable that doesn’t fog up my glasses.

Size: 10

Investors: Raised $1.1m on 2/116/21

CEO: Chris Evans

LinkedIn

Arpio **New for 2022

Pitch: Arpio is the third company to spin out from Bandwidth (Republic, ArenaCX are the other 2). While at Bandwidth, Doug built some DevOps infrastructure to help with AWS disaster recovery and Arpio is a spin out of that idea. If you are building a company on AWS, there are different zones and being ‘multi-zone’ is expensive. If your AWS zone goes down, it can be very hard to recover. Arpio provides a cost-effective way to add disaster recovery to your AWS infrastructure and increase your up-time.

Size: 10–20

Investors: $2.1m from Y-Combinator, Uncorrelated Ventures and Valor Ventures.

CEO: Doug Neumann

LinkedIn

Arya/Leoforce

Pitch: The family of software that is used by HR departments to recruit, reward and retain talent is called HRIS or HRTech (or PeopleTech). Arya (by Leoforce) uses AI to sort through those thousands of applicants and surface the best candidates. Machine learning trains the system to get better over time. Arya is the world’s first AI recruiting platform, born right here in the Triangle (Raleigh).

Size: 50–100

Investors: none

CEO: Madhu Mogudu

LinkedIn

Atlas Certified

Pitch: There are hundreds of certifications out there: home inspector, Cisco hardware, Microsoft certified X, the list goes on. There’s a hodgepodge of APIs and ways to check these things. Atlas Certified has put them all into a family of over 600 APIs that make it super easy to very and track certifications of anyone across industries. Customers include Amazon, HomeAdvisor, ADP, etc. (Note: I’m aware that Atlas was acquired 4/27/22 by CLEAR, that will be reported in the 2023 update.

Size:10–20

Investors:

CEO: David Lindsay Johnson

LinkedIn

Atmos **New for 2022

Pitch: Building a home is complicated. There are a bazillion decisions, budgeting and tracking is rudimentary, etc. Atmos is revolutionizing the homebuilding experience by giving the home owner a set of design tools that allow you to design your home, find a lot and then get matched (via a marketplace) with a builder. They are currently building only in the Triangle area. Note they are headquartered in SFO and the Triangle, and Nick is a NCSU grad, so we’re laying 50.001% ownership to this one ;-)

Size: 50–100

Investors: $6.2m from Y-Combinator, Khosla Ventures, Starship Ventures.

CEO: Nicholas Donahue

LinkedIn

Bee Downtown

Pitch: Bees, the producers of yummy honey, but also the chief pollinators of the insect-world, are dying off at an alarming pace from something called Colony Collapse Disorder. NCSU student and 4th-generation beekeeper, Leigh-Kathryn Bonner, came up with a great idea. What if you could get corporations and their employees that care about the plight of the humble bumble bee to get involved? Bee Downtown was born! Corporations can sign up for a variety of different hive options and Bee Downtown, installs them, takes care of them, does tours and educational sessions and finally delivers the honey to the company. Everyone wins, and bees get a fighting chance at survival.

Size: 10–20

Investors: none

CEO: Leigh-Kathryn Bonner

LinkedIn

Bloom AI **New for 2022

Pitch: Every business is swimming in data. Dashboards, metrics, analytics, it’s all over the place. Bloom has built a ‘data delivery platform’ to make it easy to aggregate all of your data, display it and provide actionable insights.

Size: 10–20

Investors: <none disclosed>

CEO: Amit Shanker

LinkedIn

BrightView Technologies. **Updated for 2022

Pitch: The Triangle has an unusually large group of smart people in optics, cameras and items like that. Last year we introduced you to Aqueti and this year we have BrightView Technologies. BrightView’s technology can be used for lighting and displays, but what got them on my radar (har har) is their 3D sensing technologies that are used with LiDAR for autonomous vehicles. This company last raised capital in 08/09, but seems to have seen a new resurgence because of the excitement around AV/LiDAR.

Size: 40–60

Investors: <none disclosed>

CEO: Jennifer Aspell

LinkedIn

Broadvine

Pitch: The Triangle is home to Winston Hospitality — a very large hotel developer and operator. Chances are you have stayed in one of their properties. To help manage such a large portfolio, Winston developed SaaS hospitality software. After dogfooding the software, they spun it out as a separate company called Broadvine. Now Broadvine serves over 1000 properties worldwide.

Size: 50–100

Investors: none

CEO: Lexton Raleigh

LinkedIn

Brooks Bell Interactive

Pitch: Brooks Bell Interactive started in 2003 and helps companies perform A/B testing and optimize their ‘whatever they want to optimize’ online — conversions, sales, etc. Full disclosure — Brooks was an intern for us back in 1999 and I take 100% credit for all her success since then. Brooks is also one of the co-founders of HQ Raleigh.

Size: 50–110

Investors: Bootstrap

CEO: Gregory Ng

LinkedIn

ByteBase.io **New for 2022

Pitch: I have a warm spot in my heart for DevTech (software for developers) because that was my entry into the startup world. Cara and team are building an interesting solution that gives software developers a smart scratch pad. Devs frequently have to juggle a bunch of projects and ‘notification distractions’ (Slack anyone?) which is at conflict of trying to stay in a ‘flow state’ to be able to code. ByteBase is tackling this problem in an innovative way.

Size: 10–20

Investors: $120k, Techstars Anywhere Accelerator

CEO: Cara Borenstein

LinkedIn

Cameyo **New for 2022

Pitch: Today’s big companies have a huge challenge — they have all these legacy apps like mainframes and custom windows apps, but the knowledge worker wants to work remote from home or on the road. Maybe they have a Mac or a tablet or need to access something from their phone. There are solutions like Citrix for this, but Citrix is first generation legacy app sharing. Cameyo offers a more scalable, secure and affordable alternative.

Size: 20–40

Investors: <none disclosed>

CEO: Andrew Miller

LinkedIn

CandleScience

Pitch: CandleScience is a Durham e-commerce company that helps candle-making enthusiasts find the supplies they need and enjoy the experience of making something with their own hands. It was founded in 2004.

Size: 11–50

Investors: Bootstrap

CEO: Daniel Swimm

LinkedIn

Canopy

Pitch: An on-demand company in Raleigh that operates a marketplace for home care services like lawn maintenance, pest control, gutter cleaning and pressure washing. It was founded in 2014.

Size: 10–20

Investors: $3.9M from Cofounders Capital, IFP, Sovereign’s Capital, Great Oaks Venture Capital and Lowe’s Companies

CEO: Hunt Davis

LinkedIn

Carpe Lotion **Updated for 2022

Pitch: Let’s face it, as humans we sweat. In fact the startup-world is full of crazy levels of stress so if you are reading this, unfortunately I think we’re part of a group of people that sweats more than average. Antiperspirant technology has focused entirely on the underarms. Until…Carpe! Carpe is building a total body sweat management system targeting areas such as sweaty hands and feet. Carpe is selling direct to consumers through Amazon and their products are frequently in the top 10 against national brands. **Updated for 2021 -> It’s been really exciting to see Carpe on TV and on the radio all through 2020 — these guys are doing really well.

Size: 20–50

Investors: $2.3m from Carolina Angel Network (CAN) and Triangle Angel Partners (TAP)

CEO: David Spratte

LinkedIn

CData Software

Pitch: SaaS software is great, but we end up with little pockets of data all over the place. Then you may have legacy data in an old-school relational database like Oracle or Progress. How are you going to stitch all this together? Enter CData. CData has a ‘zero code or codeless’ (this is a big buzzword these days) Data Virtualization solution that connects to over 100 different data sources so you can access all of your data regardless of legacy or modern platform.

Size: 150–200 **Updated for 2022

Investors: CData raised $140m from Updata Partners 12/16/21 **Updated for 2022

CEO: Amit Sharma

LinkedIn

ChekHub ** Tweener Fund Portfolio Company **Updated for 2022

Pitch: I have a confession to make. I love checklists. One of my favorite books is the Checklist manifesto. ChekHub is near and dear to my heart because it is software that allows you to share checklists with coworkers and break down complex tasks into….well checklists. There’s a bunch of other great productivity features, but they had me at checklists!

Size: 10–15

Investors: Tweener Fund and undisclosed other investors

CEO: Jon Trout

LinkedIn

Clinetic **New for 2022

Pitch: Clinetic takes clinical data from EHR systems, curates the data and provides the tools needed for researchers to leverage that data. Previously the data was from claims data which isn’t as detailed, current or extensive as EHR system data.

Size: 20–50

Investors: $6.4m raised from undisclosed investor

CEO: Tom Kaminski

LinkedIn

CloudFactory

Pitch: There are people all over the planet interested in doing tasks for companies on a part-time, as-needed basis. Amazon created a system — Mechanical Turk — to automate this. But it leaves a lot to be desired and is very specific to Amazon’s needs. Enter CloudFactory, which moved its headquarters from Nepal to Durham in 2014. CloudFactory has created some custom workflows for text-to-digital, audio-to-digital and CRM cleanup. This gives companies a turnkey way to solve these types of problems without building their own solutions. A cool thing is its social mission — it contracts with thousands of underemployed “cloudworkers” in cities in Africa.

Size: 100 (more on LI due to their ‘gig workers’)

Investors: $65m from FTV Capital in last round

CEO: Mark Sears

LinkedIn

CloudFuze

Pitch: We’re all fans of cloud-based software or SaaS. But what happens is you are chugging along and look up and suddenly your company has 20 different cloud vendors and your data is spread across gdrive, onedrive, box, dropbox and a bazillion other places. CloudFuze gives you the ability to move between clouds seamlessly. If you’re saying to yourself, wow, this is a great idea — I thought so too, i think we’re going to see some great things out of CloudFuze!

Size: 30–40

Investors: none

CEO: Ravi Poli

LinkedIn

CompostNow

Pitch: Do you want to be Earth-friendly but don’t have room or time to compost? CompostNow to the rescue! You simply place your compostable waste into a bin provided by CompostNow and they pick it up on a regular schedule and take it to their mega compost facility. They also bring the fertile composted soil back to you immediately so you don’t have to wait for Mother Nature to take her time.

Size: 50–100

Investors: undisclosed angels

CEO: Justin Senkbeil

LinkedIn

Constellation Digital Partners

Pitch: One of the hottest areas of startups is called FinTech (Financial Technology) and Constellation is square in the middle of that huge trend. One of the biggest consumers of FinTech software are banks and credit unions. Constellation has created what I think of as a meta-platform. Banks adopt their platform and then other innovators (mostly startups I’m guessing) can deploy new solutions quickly. Think of it as a FinTech app store for credit unions and banks to be able to adopt new software quickly.

Size: 50–100

Investors: $52.5m — their investors are largely credit unions and banks, etc.

CEO: Kristopher Kovacs

LinkedIn

The Convoy ** New for 2022 ** Tweener Fund Portfolio Company

Pitch: Yasin was a NYC->RDU COVID transplant and I had the pleasure to be one of the first folks to meet him when they moved. Some entrepreneurs just radiate a ‘startup gamma-ray energy’ that’s hard to describe until you experience it. Yasin has SGRE to spare. When he moved, he was CEO of a Fantasy sports startup that then they sold. Now he’s started Convoy. Convoy is a B2B marketplace for group buying that saves SMBs big $$ on everyday purchases. Keep an eye on this one…

Size: 10–50

Investors: $1m from undisclosed investors and Tweener Fund

CEO: Yasin Abbak

LinkedIn

Corevist **Updated for 2022

Pitch: Sam Bayer was at HAHT from 1997 to 2000 in the early days of e-commerce. He then worked at SciQuest and MarketAcuity. In 2008, he launched Corevist (aka b2b2dot0) in Raleigh. Corevist helps SAP users connect their back-office ERP to more modern e-commerce platforms.

Size: 10–50

Investors: $8.2m raised, $5.4m fresh on 4/22 including Jurassic Capital,

CEO: Andy Martin

LinkedIn

Coworks

Pitch: Coworking space is the new way to rent space. It offers both flexibility and affordability, so it’s no wonder companies from startups to Fortune 500 love it. If you’re WeWork, you can afford to build your own software to manage your coworking space and community, but what if you’re not? That’s where Raleigh-based Coworks come in. NCSU grad, DeShawn Brown founded Coworks and incubated the idea at Techstars ATL in 2019 and is back in the Triangle scaling it up.

Size: 10–20

Investors: none

CEO: DeShawn Brown

LinkedIn

Creative Allies

Pitch: Creative Allies operates a marketplace for crowdsourcing amazing content. Over 12,000 creators are active on the platform and have created over 17,000 assets. Let’s say you are a local bar and you want to have a St. Patrick’s day promotion. You can go onto Creative Allies and start a design contest and award $250 to the winner. Designers come and create the design and you award a winner. Contests range from this type of a local example all the way to national brands leveraging the power of crowdsourcing to work with the latest talent.

Size: 10–20

Investors: none

CEO: Arnie Thompson

LinkedIn

CureMint

Pitch: As dentists/dental organizations scale up, they need a centralized supplies procurement platform to control and analyze costs. That’s where Durham-based CureMint comes in. Their software gives the staff at dental offices a simple to use, intuitive shopping experience. At the same time, the administrators can measure and manage spend like a much larger company.

Size: 20–40

Investors: In 2020, Cofounder’s Capital invested $1.2m in CureMint Raised $2.2m on 10/20/21 **Updated for 2022

CEO: Brandon Patrick McCarty

LinkedIn

Cycle Labs **New for 2022

Pitch: QA and Testing is hard to do and requires a lot of investment. Frequently it’s skipped or people do double-duty. Cycle Labs provides test automation solutions that will automatically test your apps before they deploy so you avoid evil ‘escaped bugs’ that cause bad customer experiences.

Size: 20–50

Investors: $2.5m from Jurassic Capital (aka Bank of Joe)

CEO: Josh Owen

LinkedIn

Cymatic.io

Pitch: We have a nice new crop of cybersecurity companies on the Tweener list this year and the first one is Cymatic (alphabetically). Cymatic has developed technology that is client-side. That means it can help protect against one of the most prevalent and malicious attacks: javascript injection. There are tons of other benefits for their solution that are over my head, so check it out to learn more!

Size: 20–40

Investors: $4.5m from unspecified investors

CEO: Jason A. Hollander

LinkedIn

DART Innovation (aka DART Displays) **New for 2022

Pitch: DART is in a similar space to Looma Project — helping consumer product goods get their messages out in stores. Looma focuses more on Grocery (GroceryTech) and DART more dept store. (RetailTech). Basically they help brands tell their story with a digital experience via an in-store display of some kind. For example, imagine you are in BestBuy and see this wicked-cool drone. Instead of parking a sales rep there all day, what if there was an interactive display you could touch to watch a video, see features and also learn more. That’s what DART does.

Size: 20–50

Investors: $5.5m from undisclosed investors

CEO: Kenny Olson

LinkedIn

DataClarity

Pitch: We are swimming in data. In fact, you are reading data right now. Data, data, data! DataClarity provides a Analytics and Data Science Platform. The DataClarity solution seems to appeal to a wide variety of industries and ‘plays well’ with the Cognos/IBM data warehouse systems.

Size: 50–200

Investors: none

CEO: Mark Mueller

LinkedIn

Davinci/LCMS Plus

Pitch: Spun out of Duke School of Medicine in 2011, Durham-based DaVinci Education provides an enterprise software platform (“Leo”) that helps facilitate teaching, learning and accreditation management at medical schools around the country.

Size: 10–15

Investors: Bootstrap

CEO: Allison Wood

LinkedIn

Dendi Software ** New for 2022

Pitch: Let’s say you operate a clinical lab, you need a Laboratory Information System (LIS) to manage everything. It’s 2022 so you’d want a modern platform that’s cloud based, integrates with everything and enables your lab to be super nimble in today’s ever changing world. Boom, Dendi to the rescue! Dendi is a bootstrapped Triangle Tweener that quietly built a great product using the best capital possible — customer capital — congrats Jihoon!

Size: 10–20

Investors: none

CEO: Jihoon Baek

LinkedIn

Dental HQ **New for 2022

Pitch: The Triangle has a ton of DentistTech Tweeners all of the sudden. Dental HQ is Dental membership plan platform. A trend in dentistry is to offer patients a membership plan to augment/replace dental insurance. A local dentist (Dr. Brett Wells) started this and realized there was an opportunity to build software and BOOM Dental HQ was born.

Size: 20–50

Investors: $1.5m from Doug Brown

CEO: Dr. Brett Wells

LinkedIn

Demographics Pro

Pitch: Any marketer will tell you that one of the most important things they think about is demographics for whatever it is they are marketing. When you think demographics (demos as we say in the biz), you think about someone at P+G spending 300k for all this fancy data. That’s the 1985 way of thinking — enter Demographics Pro. Demographics Pro provides APIs that allow you to query: “Who are the top social restaurant influencers in Raleigh, NC?” Create an audience of people 25–30 in the SE states that are thinking about buying a car”. Demographics Pro does it all!

Size: 10–50

Investors: none

CEO: Paul Hallett

LinkedIn

Devada

Pitch: Developers are always looking for communities where they can find folks working on similar problems and share their challenges and findings. Dzone is a community of over 1m developers that enjoy fresh content, message boards and other community features.

Size: 50–200

Investors: SFW Capital Partners

CEO: Terry Waters

LinkedIn

Devana Solutions **New for 2022

Pitch: Devana connects CROs (Clinical Research Organizations) with research sites and sponsors to accelerate and lower costs of drug development.

Size: 10–20

Investors: <none disclosed>

CEO: Barry Lake

LinkedIn

Device Magic

Pitch: There are many industries such as (retail, construction, facilities, telecom) where folks are out and about doing things like inspections, inventory counts, maintenance, and things of that nature. If you want to know what they are doing, you need to arm them with a device and an optimized, low-friction ‘form’. As they are filling it out, you?ll want a variety of ways to know what’s going on and see an aggregate view of all the data. That’s exactly what Device Magic does.

Size: 20–50

Investors: none

CEO: Dusan Babich

LinkedIn

Disruptive Enterprises

Pitch: I personally believe the Triangle needs a big direct-to-consumer (DTC)/consumer product goods (CPG) win to put us squarely in the echelon of top startup cities. That’s why I’m really excited to see Disruptive Enterprises come on the scene in a big way. There are three founders: Mike McCandless (CIO), Mike Hockenberry (CEO) and Brian Kinn (CFO). These guys have too deep CPG experience for me to go into here, but suffice it to say they are 100% DTC legit. Disruptive has a family of brands and their first offerings are: FBomb — fat-smart nut butters and oils, Primaforce — supplements and Ketologic — keto-diet friendly meal replacements and supplements. These guys have experience, great products and in 2019 they raised ~$8m from One Better Ventures, so they have all the ingredients to scale up quickly.

Size: 20–30

Investors: Raised $7.5m from One Better Ventures

CEO: Mike Hockenberry

LinkedIn

Diveplane ** Tweener Fund Portfolio Company

Pitch: AI and machine learning are all the rage. But, we’ve all seen the Terminator, or read hundreds of sci-fi stories (or seen Black Mirror) where the AI’s decide, hmmm humans are kind of a problem, let’s take over the world (looking at you Skynet). Diveplane’s goal is to make responsible AIs that not only do cool AI stuff, but they are open and transparent.

Size: 20–50 **UIpdated for 2022

Investors: In 2020, Diveplane raised capital from Calibrate Ventures, bringing their total to $6m. Investors also includePresence Capital. Mike was CEO of Epic from 2004–2013, so this company has the attention of some very large investors. Wolfpack Investment Network (WIN) is an investor. Raised $2m from undisclosed investors on 9/22/21 **Updated for 2022

CEO: Mike Capps

LinkedIn

Dropsource

Pitch: This Raleigh startup provides a drag-and-drop interface for creating native mobile apps for both iOS and Android. The founder dropped out of Syracuse University in 2013 and moved to the Triangle in 2014 to grow the company. With a November 2015 funding round, it rebranded from Queue Software to Dropsource.

Size: 11–50

Investors: $10.9m in 3 rounds, investors unknown

CEO: Nate Freschette

LinkedIn

EarthOptics **New for 2022

Pitch: EarthOptics’s website really grabbed me with this one: “We are building the Soil Cloud”. EarthOptics is an AgTech company that uses proprietary sensor technology to precisely measure the health and structure of your soil. All that data is uploaded up into SoilCloud. The SoilCloud has tons of applications, one of the more interesting ones is they can measure the carbon footprint of an acre of land, which ties into the growing number of GreenTech companies in the Triangle.

Size: 20–50

Investors: $10.3m including ‘Leaps by Bayer’

CEO: Lars Dyrud

LinkedIn

EDJX

Pitch: 6fusion is the Tweener where this idea was born. EDJX is in the IoT (Internet of Things) space where they are building edge capabilities so that you can easily deploy IoT anywhere (I don’t 100% understand this, but there you go).

Size: 25

Investors: $21.7m raised from undisclosed investors

CEO: John Cowan

LinkedIn

e-Emphasys Technologies **New for 2022

Pitch: This is one of those bigger Tweeners that snuck under my radar for a long time, but we eventually got ‘em! e-Emphasys provides software for equipment rental and dealers to automate their businesses — an ERP system.

Size: 340–450

Investors: Undisclosed amount from TA Associates and others (PE firms)

CEO: Milind Bagade

LinkedIn

Element451

Pitch: Let’s say you run admissions at a higher education institution. You have 400 openings and 4,000–10,000 applications are flying at you every year. How do you manage this process? Enter element451. Element451 provides a SaaS admissions CRM system for a data-driven higher-ed admissions process. Who visited, who has accepted, who called you a million times and stopped by your house -keep all that data in one place and get better at the admissions process

Size: 50–100. **Updated for 2022

Investors: $4m raised: Raised $1m in 2019 from Cofounders Capital. Raised $3m from Cultivation Capital on 4/22/21. **Updated for 2022

CEO: Ardis Kadiu

LinkedIn

Enmass Energy **New for 2022

Pitch: Enmass is building supply chain software to manage and measure a sustainable fuel procurement process. Including scheduling, delivery details, CRM and payments. I’m not sure what all that means, but we’ll count it as GreenTech.

Size: 10–20

Investors: $2.2m from Cox/Techstars accelerator, Blue Bear Capital

CEO: Andrew Scott Joiner

LinkedIn

Entigral Systems

Pitch: A Raleigh IoT company that uses RFID technology to track assets, shipping and receiving of goods and the production process.

Size: 10–50

Investors: $1.67M in four rounds from Triangle Angel Partners

CEO: Mark Self

LinkedIn

Entrinsik

Pitch: This 33-year-old Raleigh software firm sells business intelligence software to 1,500 companies and organizations in higher education, insurance, manufacturing, nonprofits, healthcare and more. It was founded by CEO Doug Leupen.

Size: 11–50

Investors: $1.5M from Research Triangle Ventures and Catalysta Partners in 2001

CEO: Doug Leupen

LinkedIn

Epifany

Pitch: Overwhelming data shows that in today’s complex world of consumer choice, it’s smarter to spend money on the customer experience (CX) than marketing. The mantra is CX is the new marketing. The challenge though is how do you get feedback from customers on how you’re doing and how to improve your CX? That’s where Epifany comes in. Their platform allows restaurants, sports/entertainment teams and venues and health and fitness clubs to ask their customers quickly and easily via surveys via sms or proximity beacons. Then they utilize AI (Artificial Intelligence) and NLP (Natural Language Processing) to give you insights on how to improve your CX.

Size: 20–30

Investors: none

CEO: Jim Zidar

LinkedIn

Equity Shift

Pitch: Cofounded by Will Duckett and Tom Gordon, Equity Shift is a FinTech helping companies digitally automate their corporate activities. Equity Shift is a new Triangle startup that has planted a flag in this exciting space by combining critical software functions (think: document sharing and signing, paymenets, etc.) into a single platform that helps companies effortlessly manage events like raising capital, convertible notes, shareholder voting, and even employee liquidity programs! I’m excited to learn more about this one and watch them grow quickly.

Size: 10–20

Investors: $3.3m from undisclosed investors (using their platform)

CEO: Will Duckett

LinkedIn

eTailInsights

Pitch: When Darren Pierce was at Bronto, he realized that cold calling online retailers was a tough business. He left and founded eTailInsights to solve this problem. The 2011-founded Cary company gathers a large database of online retailers and their contacts to help vendors get their products in front of the right audience.

Size: 20–40

Investors: Bootstrap

CEO: Jud Vanzee **Updated for 2021

LinkedIn

Eton Solutions

Pitch: There are wealthy families across the world that are taking control of their finances and setting up family offices. A local family office developed software for managing all of their assets and investments and decided to license it. Eton Solutions was born! Category: SaaS FinTech

Size: 100–200 **Updated for 2021

Investors: Raised $11.1m in 2020 from undisclosed sources, bringing their total raised to $20.2m **Updated for 2021

CEO: Robert Mallernee

LinkedIn

Eventops

Pitch: Let’s say you are a large company and you put on a lot of events like user conferences, developer conferences, etc. There’s software out there for managing events, but you have one vendor for the CRM, one for attendee management and another that gives attendees their schedules and apps and what-not. Enter EventOPS. Their SaaS-based software has all the features an organization of any size needs to manage all aspects of an event.

Size: 10–20

Investors: none

CEO: Willy Stewart

LinkedIn

Exit Intelligence

Pitch: Retailers and others pay big $$ to get visitors to their websites. When they leave, Exit Intelligence provides behavior marketing that turns bounced traffic into customers.

Size: 20–30

Investors: none

CEO: Matt Cimino

LinkedIn

FeedTrail

Pitch: FeedTrail is a HealthTech that lets caregivers get feedback from patients on how they are doing (how do I tell every doctor I visit that they are never on time?!, but I digress) so they can improve the customer experience. Feedtrail has made a ton of progress in a short time, so keep an eye on this one!

Size: 30–50 **Updated for 2021

Investors: In 2020, FeedTrail raised $800k from undisclosed investors, bringing the total to $2.7m. Investors include Cofounders Capital and Dioko Ventures **Updated for 2021

CEO: Paul Jaglowski

LinkedIn

Feelgoodz

Pitch: On a trip, the founders discovered amazing flip-flops created from 100% natural rubber. They realized that US consumers would love sustainable, socially conscious products that also were better than traditional offerings. Feelgoodz was born and has expanded not only from their small office on Glenwood but also to other categories plus their e-commerce game is quite strong. **Updated for 2021 — they have a new sub-brand called Rising Tide that is outside of flip-flops.

Size: 30–40

Investors: Wolfpack Investment Network (WIN) is an investor

CEO: Mac Sullivan **Updated for 2021

LinkedIn

Field2Base

Pitch: If you have people in the field (maintenance, etc.) they need to be able to capture information and send it back to HQ. Field2Base has solutions for that.

Size: 11–50

Investors: In 2020, raised undisclosed amount from Black and Veatch bringing their total to $1.7m ** Updated for 2021

CEO: Ed White

LinkedIn

Finmark **Updated for 2022

Pitch: If you’re like me, you have about 400 different little excel models where one night at 2am, you’re like, Hmmm, I wonder if we doubled our prices, what would happen. If I hire 20 more SaaS sales reps this yr, what does that do to bookings and burn? The problem is these little excel nuggets get lost, forgotten and once your team is bigger, impossible to manage. That’s where Finmark comes in — you can build a financial model quickly that is shareable and also super re-usable. Finmark has a pre-set list of metrics important to different businesses so will automatigically kick all that out as well. I’m also excited we have another FinTech company in the Triangle!

Size: 30–40

Investors: $11.6m raised from investors including American Express Ventures, IDEA Fund Partners, Y Combinator, Draper and Associates and Bessemer Venture Partners

CEO: Rami Essaid

LinkedIn

FISCAL Technologies

Pitch: As companies get larger, more and more people are involved in purchasing everything from supplies to equipment and components for their solutions, etc. FISCAL has software that monitors all of that activity at a forensic level and helps look for duplicate purchases, potential internal and external fraud as well as highlighting risks from potential risky vendors. FISCAL has over 250 customers and has monitored over $7 trillion (that’s a T and not a B folks!) in spend through its platform.

Size: 80–100

Investors: Splashes onto the Tweener list with a $4.7m investment from Octopus Investments

CEO: David Griffiths

LinkedIn

Flexgen **New for 2022

Pitch: Another GreenTech, Flexgen designs and integrates energy storage solutions (batteries) and creates the software platform to manage them. This is another one that blew up quickly that we’re excited to have discovered and welcome to TweenerLand

Size: 100–150

Investors: $175m (that’s not a typo) from Altira group and Apollo

CEO: Kelcy Pegler

LinkedIn

FoodLogiQ

Pitch: In today’s world of possible noro-virus and e-coli outbreaks, food safety and traceability are huge priorities. FoodLogiQ provides a SaaS platform for managing the complete food supply chain and has more than 1900 customers with 18,000 locations as customers since its 2006 founding. It’s based in Durham

Size: 50–100

Investors: $30.8m raised from Testo, Tyson Ventures and Renewal Funds.

CEO: Sean O’Leary

LinkedIn

FotoSwipe

Pitch: Sharing pictures and media directly on your mobile devices is complicated. You can email them or text them, but that can be cumbersome. Apple’s cloud and Android/Google don’t ‘play nice together. But FotoSwipe is a mobile app that lets you seamlessly swipe photos between any device.

Size: 10–20

Investors: $1M in three rounds from Cofounders Capital and Tom Lotrecchiano

CEO: Sylvain Dufour

LinkedIn

Freedom

Pitch: The average person in the US looks at their phone 74 times a day. Now you want to look at your phone don’t you? Ok, go ahead, I’ll wait… Welcome back. Ok that feeling you just felt? It’s no secret that smartphones and apps have been purposely designed to be addictive. They give you a little shot of dopamine and boom you are hooked. Enter: Freedom. Freedom helps you break the cycle. You can use Freedom to turn off all the notifications and other distractions in your life that keep you from being productive. Now, try not to look at your phone for the next 90 minutes and if you can’t, it maybe time to give Freedom a try.

Size: 10–20

Investors: 350k seed round in 2015. Investors include Robbie Allen, Mark Easley, Henry Copeland, MDO ventures, and Pilot Mountain Ventures.

CEO: Fred Stutzman

LinkedIn

Get Spiffy **Updated for 2022

Pitch: An on-demand mobile app that allows you to schedule an at-work and at-home car wash or other preventative maintenance within minutes, founded in 2014. All communication and payment is handled through the app making this the most convenient way for you to keep your car Spiffy. The company is based in Durham.

Size: 100–150

Investors: Tribeca Venture Partners, Bull City Ventures Partners, IFP, Wolfpack Investment Network (WIN) are investors. Raised $22m from Tribeca Venture Partners 10/26/21

CEO: Scot Wingo

LinkedIn

Full disclosure: I’m a founder, investor and CEO of this company.

GIBLIB

Pitch: A big trend in EdTech is a marketplace/Netflix approach for different verticals. GIBLIB provides doctors the ability to hear from the top of their field about a variety of topics from subject matter experts. No more hopping on a plane to a painful trip to Bermuda for a conference, now the Docs can get all the content they need online and stay up to speed on the best practices and procedures. GIBLIB is the Netflix of medical education. Note they + CEO just moved to the Triangle from Los Angeles — welcome home!

Size: 20–30

Investors: $7.6m from the Mayo Clinic, Strong Ventures and Global Ventures.

CEO: Brian Conyer

LinkedIn

Global Data Consortium

Pitch: In many lines of business, you need to verify the identity of your customers and trading partners. GDC gathers information into the cloud and provides a SaaS system that delivers Electronic Identify Verification. There are other uses for the system such as data cleansing and address verification.

Size: 40–50 (I’m aware they sold in 22, will be updated next year -congrats Bill!)

Investors: $3.6 from undisclosed investors

CEO: Bill Spruill

LinkedIn

Global Value Commerce (aka Global Golf)

Pitch: Ed Byman was a pro golfer on the PGA tour and in 2001 realized there was an opportunity to sell golf equipment online. He’s built GVC into a global golf company carefully tucked away here in Raleigh. Full disclosure — this is a ChannelAdvisor customer.

Size: 100–200

Investors: $500k from Southern Capitol Ventures

CEO: Ed Byman

LinkedIn

Green Energy Corp

Pitch: There’s a ton of innovation going on around alternative energy sources. Solar power, battery technology, smart meters, smart grids and more. Green Energy has created the GreenBus Microgrid Solution to provide a SaaS solution to pull all of this together in one system. After many companies in the ‘CleanTech’ space went under in 2000–2010, the space was very hard, but now it has come back and Green Energy appears to be well positioned.

Size: 10–20

Investors: none

CEO: Peter Gregory

LinkedIn

Greenlight Health

Pitch: Greenlight gives patients the ability to aggregate and get access to their electronic health records that are spread across a variety of sources. This technology was incubated at Medfusion that was started and sold twice (I like this model too) by local tech startup and soccer entrepreneur Steve Malik.

Size: 10–20

Investors: none (well, I imagine Bank of Steve involved).

CEO: Steve Malik

LinkedIn

Green Places **New for 2022 **Triangle Tweener Fund Portfolio Company

Pitch: One of our most awesome ‘move back to Triangle during Covid’ folks is Alex Lassiter. Alex is a UNC grad who moved to ATL, co-founded Gather (software for restaurants), sold that for 9 figs and then moved back to the Triangle. The urban legend is that over dinner, Alex and Jess Lipson (see Levitate) were having dinner and dreamed up the idea for Green Places. I got an early pitch and because we had this challenge at Spiffy gave it two thumbs up (full disclosure: Spiffy is a customer, I am investor, Triangle Tweener Fund is investor). In a nutshell, Green Places allows a SMB to track their carbon footprint by connecting in all your data and then also offset that so that you can be carbon neutral.

Size: 10–20

Investors: $1m+ from undisclosed investors (including Tweener Fund)

CEO: Alex Lassiter

LinkedIn

GrowPath** New for 2022

Pitch: Let’s say you are a legal firm that takes on a lot of cases for your clients. You’ll need something like a legal firm ERP to manage all that. This was built by a large legal firm for their internal needs, has been productized and they have brought in GTM (Go-to-market) guru Neal Goffman who helped GTM scale up Vanguard Software. Now he’s scaling GrowPath and has already gotten it up to Tweener levels.

Size: 20–30

Investors: none disclosed

CEO: Neal Goffman

LinkedIn

Hexawise

Pitch: Hexawise is in one of my favorite categories: DevTech — technology that helps software developers. Their solution is in the testing part of development. Today’s engineering teams are generating code faster than ever which means, how are you going to test all this code being produced? Enter Hexawise. Their solution is low-code — as a non coder I can build tests based on scenarios like: “Someone goes to the tweener list, presses this button and then they scroll here and do this and then that” and then hexawise takes care of the rest.

Size: 10–20

Investors: none

CEO: Justin Hunter

LinkedIn

Hi Fidelity Genetics

Pitch: I love this tagline: “Plant breeding is analog, we are making it digital”. To that end, HFG is an AgTech company that mixes IoT sensors, data science and genomics to create better seeds. It turns out the secret sauce is in the roots. That’s where my understanding stopped and if you want to learn more, their site has some deep papers on the topic.

Size: 10–20

Investors: none

CEO: Bill Niebur

LinkedIn

Higgs Boson Health **New for 2022

Pitch: Better patient engagement, better provider workflows, better outcomes. I don’t know exactly what that means, but we’re clearly dealing with a HealthTech co here. Digging in, HBH provides patients a ‘manage my surgery’ functionality that allows them to know exactly what is going to happen, when and to better understand the healthcare experience.

Size: 20–50

Investors: $600k from undisclosed investors

CEO: Rajeev Dharmapurikar

LinkedIn

Higharc

Pitch: Building a house is an overwhelming process and usually designed ‘backwards’. You look at plans and find ones you like that may or may not meet your needs. Higharc has software that allows you to ‘flip’ the process and start with your needs and then generate 3D plans from there. With the 3D plans, you can visualize your plans completely to ‘try on’ the design of your house. You could even envision this paired with virtual reality to take home design to the next level. Higharc has raised ~$5m to bring their idea to life.

Size: 40–50 **Updated for 2022

Investors: Raised $4.7m from Pillar VC in 2019. Raised additional 21m from Spark Capital on 4/21/21 ** Updated for 2022

CEO: Marc Minor

LinkedIn

Hip Ecommerce ** Tweener Fund Portfolio Company

Pitch: Mega e-commerce sites like eBay and Amazon are so big they don’t provide great vertical shopping experiences. Hip Ecommerce’s CEO Mark Rosenberg is a stamp and comic collector. He grew frustrated with this fact and decided to change it. Hip Commerce builds vertical marketplaces (comics, postcards and stamps so far) that are heavily customized for the collector. Want that near-mint condition, CGC graded, Amazing Spider-Man number 300? Go to Hipcomic.com and find that puppy faster than you can anywhere else. Full Disclosure: I’m on the board of Hip Ecommerce and angel investor.

Size: 20–40 **Updated for 2021

Investors: In 2020, Hip Ecommerce raised $5m+ in 2020 from Next Coast Ventures. **Updated for 2021

CEO: Mark Rosenberg

LinkedIn

Home Lending Pal

Pitch: In the world of 2021, HLP seems to be split between RDU and MCO, so we’ll claim them because they are FinTech and solving some cool problems. Instead of going through endless forms to figure out your mortgage situation, they have developed an AI persona, named Kev, that walks you quickly through the process and only needs 9 questions asked. After that, boom, Kev presents you with up to 9 offers from lenders and walks you through the process after that.

Size: 10–20

Investors: none

CEO: Steve Better

LinkedIn

IdeaBlock

Pitch: There’s lots of hype (some would say too much) around Bitcoin and crypto-currencies. But, most agree the underlying technology, blockchain, is going to dramatically change enterprise software and other industries by providing a decentralized ledger of activities. Ideablock is using blockchain to protect intellectual property. Let’s say you come up with a novel idea. In the past, the best way to document and ‘start the clock’ on your invention was to start the expensive patent process. IdeaBlock allows you to upload your idea to their decentralized system and create an immutable time stamp in the blockchain.

Size: 10–20

Investors: none

CEO: Eli Sheets

LinkedIn

Imangi Studios

Pitch: We all love to play mini-games on our phones, but did you know that one of the top studios in this category was born and raised right here in the Triangle? Ever heard of Temple Run? Yep, that’s an Imangi game and they are based right here in the Triangle!! I would write more, but I have to go get some coins and multipliers and crush my last high score.

Size: 20–50

Investors: none

CEO: Keith Shepherd

LinkedIn

Impact Karma

Pitch: As you’re shopping and working with different brands, wouldn’t it be cool to know how sustainable that brand is? Impact Karma has Karma Wallet that tells you the ImpactIndex score of brands as you shop. If a brand scores lower, Karma Wallet can recommend a more sustainable alternative.

Size: 10–20

Investors: none

CEO: Jayant Khadilkar

LinkedIn

Impathiq

Pitch: Impathiq helps you read other people’s minds! Err, sorry that’s telephatic, but Impathiq is almost as cool. In the HealthTech world, hospitals use either Epic or Cerner systems. Impathiq has built tools on those systems that help with Electronic Patient Health Records (EHR). The big one I have no idea what it is, but here goes: It’s a high-sensitivity Troponin. The other thing you need to know about Impathiq is they were founded by three Emergency physicians who saw the need and went and built a solution. Kim joined after successfully selling and transitioning Medfusion to NextGen (announced 2019, closed 2020).

Size: 10

Investors: $350k from Cofounders Capital

CEO: Kimberly Labow

LinkedIn

Improved Nature

Pitch: Because of the cost and environmental impact of meat, one of the hottest category in consumer product goods is plant-based meat alternatives. Improved nature here in the triangle has developed technology that gives plant-based meats the same texture as real meat, dramatically improving the functionality of meat alternatives.

Size: 50–100

Investors: In 2020, Improved Nautre received an additional $1m from undisclosed sources. This brings the total to $10m raised. Investors include Wolfpack Investor Network (WIN).

CEO: Rody Hawkins (Fun fact — he’s the ‘father of lunchables!”)

LinkedIn

Infina Connect

Pitch: Infina Connect is a SaaS platform that automates and optimizes the physician referral network system. Founded in 2010, it’s based in Cary.

Size: 10–50

Investors: >$1.9M in three rounds, investors undisclosed

CEO: Mark Hefner

LinkedIn

Infinia ML

Pitch: There’s a lot of hype around AI and Machine Learning — some would say too much hype. Infinia ML breaks through the hype and uses machine learning secret sauce born out of Duke to solve real-world problems.

Size: 20–50

Investors: $10m from Carrick Capital Partners

CEO: Rob Delaney **Updated for 2021

LinkedIn

InHerSight

Pitch: Durham-based InHerSight is focused on creating better workplaces for women. They do this by allowing working women to rate thousands of businesses on criteria that are top priorities to women. On the employer-side, you can get valuable data on what areas are not only important to female applicants, but where you are doing well vs. where you need to improve to attract and retain more female team members.

Size: 10–20

Investors: none

CEO: Ursula Mead

LinkedIn

InsightFinder ** Tweener Fund Portfolio Company

Pitch: A big area of innovation in developing software is devops — the stuff that happens with your code when you ‘ship’ it to production and also make sure your site stays up. Splunk, DataDog and New Relic are all examples of very big public co’s in this space. InsightFinder has put together a stellar team and married it with technology that has 15yrs of research behind it. The result — they are able to use modern AI to look at your production data and predict when problems are going to happen. Try this pitch out at your next cocktail party-> InsightFinder uses patented anomaly detection algorithms to detect true anomalies and reduce spurious alerts.

Size: 10–20

Investors: IDEA Fund Partners (IFP)

CEO: Xiaohui (Helen) Gu

LinkedIn

Instancy

Pitch: I remember back in like ’99 I met Harvey for coffee and he was SUPER fired up about the impact of technology on education, so started his first company MindLever that he successfully sold after 2yrs to a bigger EdTech company: Centra. I was excited to learn that he’s back at it again with Instancy which is a learning ecosystem and marketplace. Unsurprisingly, the company has gotten pretty big very fast. Welcome back to the game and the Tweener list Harvey!

Size: 90–100

Investors: Bootstrapping this puppy it seems.

CEO: Harvey Singh

LinkedIn

InterviewUp/ThinkOptimal/OptimalResume

Pitch: ThinkOptimal offers several products that allow job seekers to optimize their resumes and prepare for interviews. This is in the HRIS category of software. (Human Resource Information System)

Size: 20–30

Investors: none

CEO: Dave McNasby

LinkedIn

Intervolve

Pitch: Another interesting area of focus for the Triangle is AlcoholTech or I guess we can subcategorize it to BeerTech. The AB industry has a complex three-tier distribution system and Intervolve builds software for tracking where the inputs and outputs in the supply chain are through the entire process. Or more simply stated: Where’s my Keg!? <- They can answer that.

Size: 15–20

Investors: none

CEO:

LinkedIn

Investiquant

Pitch: Scott Andrews has been in the Triangle startup scene since starting SciQuest back in ’95. His latest venture, Cary-based Investiquant, provides independent (not tied to a specific brokerage) software for stock traders. Professional traders have access to the latest quantitative algorithms and technologies that allow you to create a trade idea, back-test it and then roll it out. Investiquant democratizes trading by providing the same technologies to individual traders or small/medium size traders.

Size: 10–20

Investors: none

CEO: Scott Andrews

LinkedIn

JupiterOne. **Updated for 2022

Pitch: JupiterOne is in the CyberSecurity world and focuses on the topography side of things — what are all the digital assets in your organization and how do you make sure you’re tracking that first so you can then look at the security applied to that topography. It will reach out to your IT/MIS side, your AWS and all your assets to understand the numerous touch points we all have in today’s cloud-enabled, connected world.

Size: 100–150

Investors: $19m — from Bain Capital Ventures and Rain Capital details here. JupiterOne raised an additional $30m from Sapphire Ventures on 5/4/21. As of this writing, they are now in the unicorn club after raising an additional $70m.

CEO: Erkang Zheng

LinkedIn

K4Connect

Pitch: Scott Moody’s previous company created the technology that is now used by Apple (via acquisition) for its Touch ID finger print sensor. Now in Raleigh, Scott’s newest company (founded 2014) has an IoT platform that allows it to rapidly develop and release solutions oriented towards the older adult market. It’s got a contract to roll out the technology in senior living communities across Pennsylvania and is starting to expand to others with new funding.

Size: 50–100

Investors: In 2020, K4Connect raised $7.7m from AXA Venture Partners, ForteVentures, Intel Capital and Revolution Ventures. That brings the total raised at K4 up to $29.6m **Updated for 2020

CEO: F. Scott Moody

LinkedIn

Kaleido

Pitch: Let’s say a large company has a great idea that would rely on an enterprise-grade blockchain solution. There are many solutions out there, but they all have limitations. Open-source puts all the work in your hands. Blockchain-as-a-service providers sound good but lock you into one platform and cloud platform. Kaleido has developed a solution that is full-stack and cross-platform so it doesn’t have the downsides of other blockchain offerings.

Size: 10–20

Investors: none

CEO: Steve Cerveny

LinkedIn

Keen Decision Systems

Pitch: Helping CMO’s understanding the efficacy of their marketing is big business and the entire category is called MarTech. Keen provides SaaS software for measuring marketing performance and then uses machine learning to formulate a plan to achieve goals.

Size: 10–20

Investors: $3.5m round in 2019 from Spring Mountain Capital

CEO: Greg Dolan

LinkedIn

Keona Health

Pitch: This Chapel Hill-based healthcare IT company allows patients to communicate more directly with caregivers than using existing processes. Think of it as chat/messaging for your doctor.

Size: 50–110

Investors: In 2020 Keona raised additional undisclosed amount from Riverside Acceleration Capital on top of the privious $2.5M from Blueprint Health. **Updated for 2021

CEO: Oakkar Oakkar

LinkedIn

Kevel (previously Adzerk). **Updated for 2022 — name change along with Fulcrum round

Pitch: There are a variety of ad servers out there, but large publishers have very specific needs. They could build their own ad servers, but the costs are prohibitive. Enter Adzerk, an AdTech (advertising technology) company. Adzerk gives publishers a set of APIs that allow them to build their own custom servers and then Adzerk takes care of the complexity on the back end. This creates the best of both worlds: customization capabilities plus scalability at a great price.

Size: 70–100 **Updated for 2022

Investors: $12.2m from Fulcrum Equity Partners, Great Oaks Venture Capital, Brian Handly (of Reveal Mobile) and other angels including TAP (Triangle Angel Partners) and I’m also an angel investor here. **Raised an additional $10m from Fulcrum 12/9/21 **Updated for 2022

CEO: James Avery

Klearly ** Tweener Fund Portfolio Company

Pitch: The Triangle has a rich history of MarTech (Marketing Technology) and the latest startup on the scene is Klearly. Klearly uses data science and machine learning technology to help sales and marketing teams quantify what’s working and recommends the optimal actions to drive sales and marketing economically. With Idea Fund Partners as a backer and over $2m raised, Klearly has a lot of momentum heading into 2020.

Size: 10–20

Investors: $1.5m raised in 2019 led by Idea Fund Partners (IFP). Raised additional $1.6m on 4/30/21 **Updated for 2022

CEO: Alex Krawchick

LinkedIn

LabVoice

Pitch: Let’s say you work in a laboratory with all this equipment like balances, centrifuges, sampling devices, etc. Wouldn’t it be cool to say: “Alexa, what’s the sample weigh? Run a centrifuge on high for 10 minutes…” and also have all of that data and workflow captured in the cloud? That’s what LabVoice does, but instead of Alexa, they have their own hardware called the LabVoice smart device. The device married with their software makes that science fiction a reality.